House gives tentative approval to tax reform bill

Income taxes would drop slightly under the Republican-crafted plan but liberal groups say the measure would amount to a tax increase on most North Carolinians.

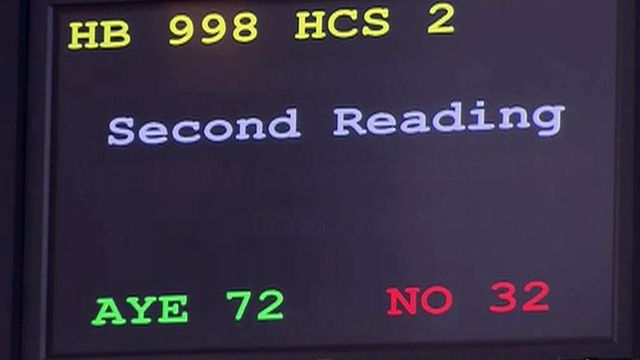

Posted — UpdatedLawmakers voted 72-32 in favor of the bill, which faces another debate and vote on Monday night before moving to the Senate. Senators are working on their own version of a tax reform bill that is markedly different from the House version.

"Today, Republicans are fulfilling a promise we made to the voters of this state," said Rep. Edgar Starnes, R-Caldwell. "We have talked about tax reform for decades. Until today, it’s been nothing more than just that – talk."

The House bill trades off cuts to corporate and personal income tax rates in exchange for higher taxes on electricity and expanding the sales tax to certain services that are attached to physical goods, such as car repairs, electronics warranties and appliance delivery.

House Bill 998 includes the following provisions:

- Does away with a three-tiered income tax system with rates as high at 7.75 percent in favor of a flat 5.9 percent income tax rate.

- Exempts some income – $12,000 for a family of four – from any income tax.

- Lowers the corporate income tax from 6.9 percent to 5.4 percent.

- Expands sales taxes to services associated with physical products, such as warranties, repairs and delivery.

- Unlike previous House versions and the Senate plan, the bill does not cut the combined sales tax rate.

- Expands the child tax credit from $100 to $250.

- Provides either a standard deduction – $12,000 for married couples filing jointly – or up to $25,000 in itemized deductions of mortgage interest and local property taxes. It allows for unlimited itemization of charitable deductions.

Critics of the measure say those broader sales taxes will hurt low-income people more, while higher-income earners will see the lion's share of the tax cut.

"This is a millionaires' tax cut bill," said Rep. Paul Luebke, D-Durham.

Earned Income Tax Credit ends

Lawmakers have been debating tax reform since the legislature opened its session in January, but Friday's debate marks the first time a bill has made it to the floor of either the House or Senate chamber.

Rep. Larry Hall, D-Durham, focused on the fact that Republican lawmakers let the state Earned Income Tax Credit expire in earlier legislation. Republicans don't include the loss of the EITC in their calculations about who would pay more or less under their plan.

"Do we remember that we gave a tax increase to those 990,000 working families? No. We don't even mention it," Hall said.

But Republicans pushed back, saying that their tax reform proposal offers a zero-tax bracket to the same families who would have taken advantage of the EITC.

"In effect, this particular tax plan is providing a lot more relief," said Rep. John Blust, R-Guilford.

Hall insisted that the tax plan would be detrimental to most North Carolina taxpayers.

"It's a tax increase on 95 percent of North Carolinians," he said. "We may be fooling ourselves, but you're not fooling those who will have to pay more taxes."

Projections by the legislature's fiscal staff show the vast majority of earners would pay less under the Republican plan, even if it's just a few dollars less every year.

"I'm having a hard time following where you're getting your facts saying that 95 percent (of people) will get a tax increase," Blust said. "Aren't you engaging in a bit of demagoguery with not accurate facts?"

Hall was citing one of a number of groups that have weighed in on the tax reform debate. The liberal leaning Budget and Tax Center says, "taxpayers with income less than $169,000 will, on average, see their taxes increase under House Bill 998. This is because the sales tax expansion will hit middle- and low-income taxpayers who spend more of their annual income harder than the wealthiest taxpayers."

But other groups, such as the conservative Americans for Prosperity, applauded the bill.

"The Tax Simplification and Reduction Act would provide $1.6 billion in tax relief to North Carolinians over five years and dramatically improve North Carolina's tax competitiveness in our region of the country," said AFP state director Dallas Woodhouse.

Electricity taxes rise

Even taking the legislature's own numbers at face value, Luebke pointed out that a family of four earning $40,000 per year would see less than $100 worth of benefit from the tax shift, while a similar family making $4 million per year would see more than $62,000 in benefits.

Republicans acknowledged the disparity but said there was good reason for it.

"Of course, those who pay more taxes are going to get more of a cut because they pay more taxes. That's simple math," Rep. Tim Moore, R-Cleveland, said. He argued that lower income tax rates would benefit businesses, who would then in turn be induced to relocate and expand here, creating more jobs.

"When we put these tax cuts through, it's going to make our state more competitive and bring in more jobs," Moore said.

Democrats tried to amend the bill several times. One attempted tweak by Hall would have restored the EITC by keeping a higher tax bracket for those earning more than $1 million.

Another set of amendments by Democrats was aimed at paring back an increase in the sales tax on electricity. Rep Yvonne Holley, D-Wake, said that tax increase would be particularly burdensome to low-income people who had "to run a fan all night" to beat the summer heat.

Republicans used a procedural measure to set aside all of the amendments offered by Democrats, choosing to cut off debate and "lie them upon the table" rather than vote on the measures directly.

Rep. Mickey Michaux, D-Durham, noted the bill would cost the state $302 million over the next two years. That money, he said, would be better put toward teacher raises or paying for health care needs.

The state House is expected to debate the tax measure again on Monday night.

Related Topics

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.