Insurers make case for big rate hike

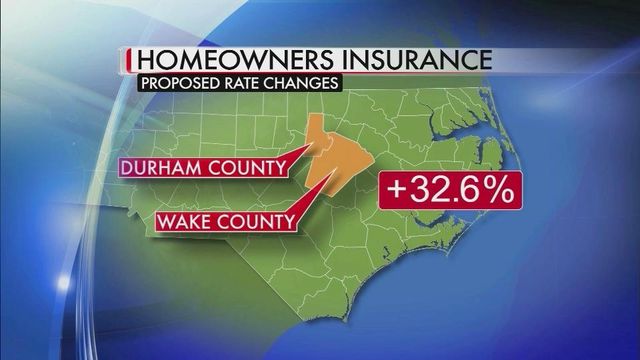

Under the proposal, the price of a homeowner policy in Cumberland County would go up almost 34 percent and by about 33 percent in Wake and Durham counties - although only 25 percent in Raleigh and the city of Durham. Homeowners in Chatham and Orange counties would see almost an 18 percent increase in their insurance policies.

Posted — Updated"What we believe is that the premiums being charged now are inadequate," said Ray Evans, general manager of the Rate Bureau.

Under the proposal, the price of a homeowner policy in Cumberland County would go up almost 34 percent and by about 33 percent in Wake and Durham counties – although only 25 percent in Raleigh and the city of Durham. Homeowners in Chatham and Orange counties would see almost an 18 percent increase in their insurance policies.

"That's what the losses say it should be," Evans said.

Insurance Commissioner Wayne Goodwin said he is "appalled" by the proposal. His office said he called the hearing because the proposed rates appear to the Department of Insurance to be excessive and discriminatory.

"Roughly a 10 percent decrease is what (DOI officials) think is justified, based on the actual data," said Kerry Hall, a DOI spokeswoman.

Experts from the Rate Bureau and the Department of Insurance will present their cases to Insurance Commissioner Wayne Goodwin over the next few weeks.

More than 10,000 public comments were submitted in January, and 25 people spoke during a hearing held that month.

"By law, the commissioner's job with homeowner's insurance rates is to make sure the rates are not excessive, that they're not unfairly discriminatory, but also that they're adequate so that insurance companies can pay out claims, particularly in the case of a large-scale disaster," Hall said.

A decision is expected by the end of the year.

• Credits

Copyright 2024 by WRAL.com and the Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.