Expert: Retirement savings accounts can cost you

A new study reveals that retirement savings plans could be costing you big time.

Posted — UpdatedMillions of Americans put money into a 401(k) plan, hoping to spend their post-work years in relative comfort. Now, a new study from Consumer Reports reports that, if you don't pay attention to these accounts, hidden fees can eat into your retirement goals.

Like many families, the Harwood family has been putting money into 401(k) accounts for 18 years. They hope to retire by age 70.

"My husband and I have two kids and we both work," said Courtney Harwood. "We save as much as we can, but we do worry that it's not going to be enough."

As if saving enough money for a decent retirement age isn't stressful in itself, many people don't notice the fees that apply to these accounts, which can often cost tens of thousands of dollars.

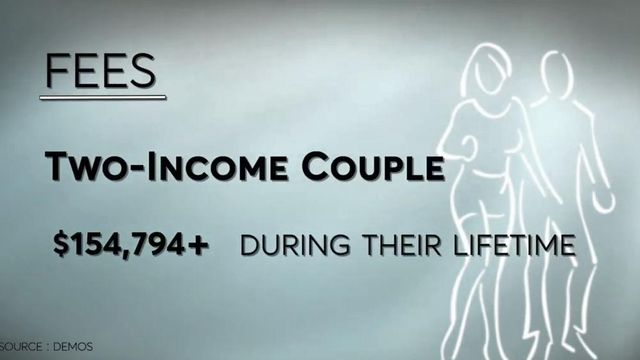

According to Consumer Reports, a typical two-income couple will pay more than a startling $150,000 in these fees over the course of their lives.

"That's a whole lot of money coming out of your nest egg that you could otherwise use later on," said Tobie Stanger, a money editor at Consumer Reports.

What can you do to prevent this loss? Look for plans with lower fees.

Consumer Reports recommends "target date funds," which are also known as a lifecycle, dynamic-risk or age-based funds. According to Consumer Reports, this type of plan is a good option for your 401(k), as it fluctuates over time based on your expected retirement date.

With this plan, fees are as low as .08 percent, or just 80 cents for every $1,000 you've invested.

It also pays to start planning early, experts say. If you're making an annual salary of $50,000 at the age of 45 and are hoping for the same lifestyle in retirement, you should save $90,000.

"Doing all this may seem daunting, but if you up your contributions often along with your raises every year, it can really add up in the end," said Stanger.

• Credits

Copyright 2024 All Consumer Reports material Copyright 2017 Consumer Reports, Inc. ALL RIGHTS RESERVED. Consumer Reports is a not-for-profit organization which accepts no advertising. It has no commercial relationship with any advertiser or sponsor on this site. For more information visit consumer.org (http://consumer.org/)