Campaign urges lawmakers to restore tax break for rehabbing historic buildings

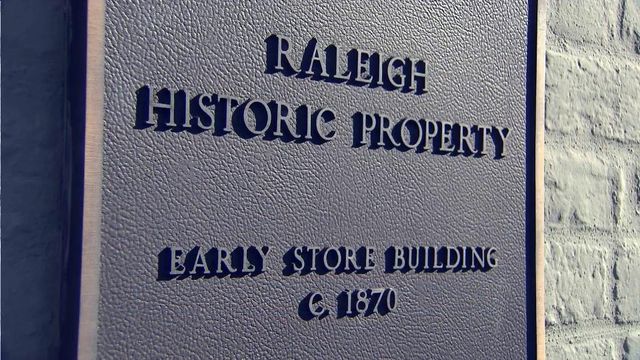

A social media campaign is urging state lawmakers to bring back a tax credit given to developers who restore historic buildings for new uses.

Posted — UpdatedThe credit was eliminated in a tax reform package the General Assembly passed in 2013. It formally expired on Jan. 1.

"These tax credits have made a world of difference that you see on the ground," said Myrick Howard, president of Preservation North Carolina.

The American Tobacco Campus in Durham, the carousel at Pullen Park in Raleigh and projects at Saint Augustine's University all benefited from the tax credit.

"There are a lot of projects that we wouldn't otherwise have been able to do if there hadn't been this incentive program in place," said Andrew Stewart, president of Empire Properties.

Empire has renovated some 40 historic buildings in Raleigh, and Stewart said 15 of those qualified for the tax credit, totaling $35 million in investment. Those include all six of its restaurants, like Gravy and Sitti, which employ more than 600 people.

"I think it’ll slow down activity," he said of the loss of the credit. "We’re already looking at what projects we’re going to do and which projects we need to hold off on."

"It's always cheaper to tear down a building and build a new one than it is to rehab an old one, but if you do that, you both lose the history and the character and interest," White said.

White hopes the social media campaign will help constituents connect with reluctant lawmakers. The credit has helped revitalize downtowns from Durham to Asheville, she said, and rural communities have also used it to restore everything from textile mills to historic homes.

"There are several small towns that the key lifeline to success has been through these tax credits, whether it’s a brewery that went in downtown ... (or) in Edenton, where the tax credits made a big difference for renovating 60 small houses," Howard said.

The credit costs North Carolina about 15 cents for every dollar spent, he said, adding that Tennessee is the only other state in the region without a historic redevelopment tax credit.

"It’s a good deal, and that renovation is all local – all local jobs. You can’t outsource this," he said.

House lawmakers tried last year to restore the credit, but Senate lawmakers blocked the move. Senate President Pro Tem Phil Berger signaled Thursday that the chamber's position probably won't change.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.