BofA settlement will return some money to shareholders

Bank of America agreed to a series of reforms Thursday to resolve the pending state and federal investigations into whether the bank misled investors about Merrill Lynch when it acquired the Wall Street bank in late 2008.

Posted — UpdatedBank of America has been accused of failing to properly disclose losses at Merrill and bonuses paid to investment bank employees before the deal closed.

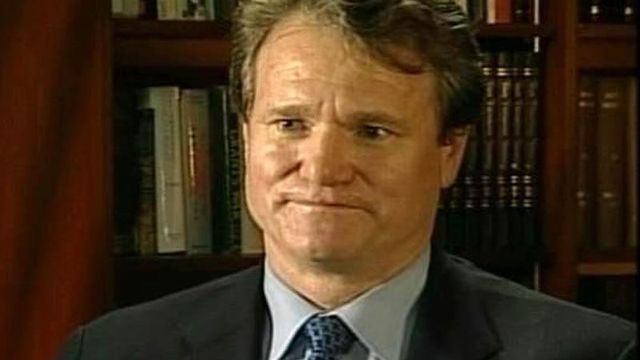

CEO Ken Lewis stepped down from Bank of America on Dec. 31 after almost a year of strife that followed the merger.

North Carolina Attorney General Roy Cooper announced the settlement, noting that shareholders could get up to $150 million from the bank in restitution for money lost. How that money will be distributed and to whom will be determined by the federal government, Cooper said. The agreement still must be approved by Judge Jed S. Rakoff of the United States District Court for the Southern District of New York.

The bank received $25 billion in bailout funds from American taxpayers and an additional $20 billion to help offset losses it absorbed as part of the Merrill Lynch acquisition. In December, Bank of America repaid both of those debts.

Bank of America leaders also agreed to maintain a hotline so employees can anonymously report any violations or problems and to meet semiannually with Cooper to discuss how whether they are sticking to the agreement.

“I’ve talked with the new leadership of Bank of America, and I appreciate their continued commitment to North Carolina and their willingness to resolve this dispute in a positive way,” Cooper said in a statement.

Bank of America will also pay $1 million to the state Department of Justice for consumer protection and education efforts.

The other terms of the federal settlement require that Bank of America:

- Retain an independent auditor to audit internal disclosure controls.

- Have its CEO and CFO certify that they have reviewed all annual and merger proxy statements.

- Retain disclosure counsel who will report to and advise the board’s Audit Committee on the bank’s disclosures, including current and periodic filings and proxy statements.

- Adopt a “super-independence” standard for all members of the board’s Compensation Committee that prohibits them from accepting other compensation from the bank.

- Maintain a consultant to the Compensation Committee that meets super-independence criteria.

- Provide shareholders with an annual non-binding say on executive compensation.

- Implement and maintain incentive compensation principles and procedures and prominently publish them on Bank of America’s Web site.

Copyright 2024 by WRAL.com and the Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.