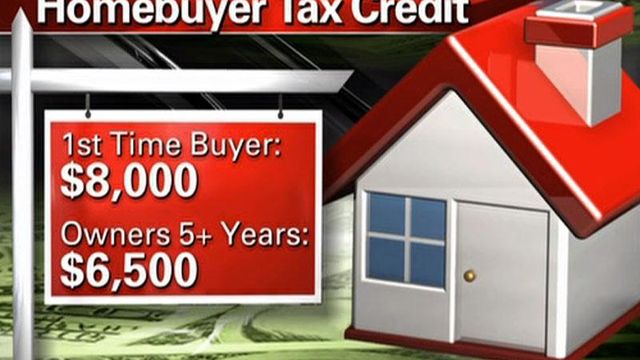

New, existing home buyers get new tax credit

Potential home buyers got an extra incentive Friday when President Barack Obama signed a bill extending a tax credit for first-time buyers and creating a new one for existing homeowners.

Posted — Updated"The nice thing about this bill is it's not just for the first-time home buyers; it's for existing homeowners as well," said Jeremy Salemson, CEO of Corporate Investors Mortgage Group.

The bill gives a $6,400 credit to existing homeowners when they move into a new house and rescues the $8,000 tax credit for first-time home buyers from expiring in November.

"It likely would have led to really, sort of, sales dying immediately," Salemson said.

To get the credit, home buyers must meet the following conditions:

- Contracts must be signed by or on April 30, 2010, and deals must be closed by or one May 31, 2010.

- Existing home buyers must have owned their current house for at least five years.

- Single taxpayers with an adjusted gross income under $125,000 and joint filers with an income of up to $225,000 are eligible for the full credit. Individuals with an income of up to $145,000 or couples with an income of up to $245,000 can receive partial credit.

- Homes worth $800,000 or less are eligible.

- The home must be the buyer's primary residence. It does not apply to second homes or investment properties.

- Members of the military serving outside the United States for more than 90 days will have until June 30, 2011, to qualify for the incentive.

"It gives a great incentive," said Zach Schabot, with Garman Realty. "If someone has the means to purchase a home, I think it's just an added bonus."

Some real-estate experts said they hope the new or extended credits help keep driving up home sales. The National Association of Realtors says that an additional 350,000 homes have sold because of the current first-time home buyers' tax credit.

"I think this is going to be a huge shot in the arm," Salemson said. "We're really hoping that this will be the catalyst that we need to get housing and, therefore, the economy back on track."

The tax credit is expected to cause $10.8 billion in lost federal taxes.

• Credits

Copyright 2024 by WRAL.com and the Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.