Blue Cross CEO: Still weeks away from solving enrollment problems

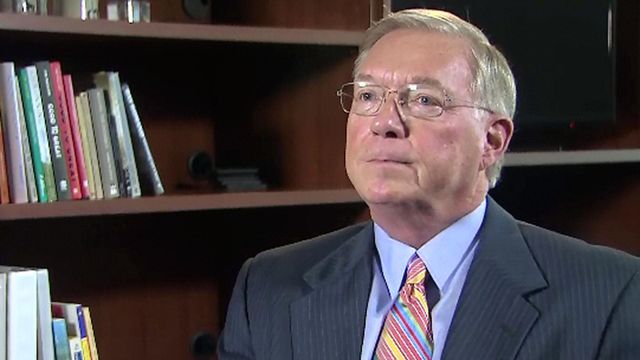

Blue Cross Blue Shield of North Carolina continues working to resolve customer problems that started more than two months ago, and Chief Executive Brad Wilson said Wednesday that the company is still weeks away from finishing.

Posted — UpdatedThe state's largest health insurer opened the year with about 25,000 customers who were either enrolled in plans they never signed up for or had the wrong amount of money drafted from their bank accounts. Others waited weeks for identification cards to prove to providers that they had health coverage.

The company's customer service center was swamped by thousands of irate calls, leaving many people frustrated and even angrier because they couldn't speak to anyone to get their problems addressed.

"It was an avalanche that overran us," Wilson said in an interview with WRAL News. "Once you get behind, it takes a while to dig out."

The volume of calls to the customer service center has ebbed back to normal levels, Wilson said, blaming the problems on enrollment software that failed amid a crush of people signing up for coverage in late December.

"It set off a cascade of events that ran through the system," he said, noting that enrollment data was then tied to benefits, premiums and claims. "We’ve got plenty of work left to do, but we’re going to stay at this until every customer’s concerns, problems, challenges have been met."

The subsequent flood of complaints to the state Department of Insurance prompted Insurance Commissioner Wayne Goodwin to order a performance audit of Blue Cross to determine whether any state regulations were violated. Wilson said the process started Monday.

"I cannot speculate whether or not we deserve a fine or whether they will ultimately levy one," Wilson said. "What I do know is that we are going to fully cooperate with them, (and) we’re going to learn as much as we can from the process."

Blue Cross also is studying its future under the Affordable Care Act after losing $282 million on plans purchased through the HealthCare.gov marketplace last year. That was more than double the $123 million the company lost on such plans in 2014.

"It's time we take stock as prudent businesspeople and understand what it means for our company," Wilson said.

No decisions will be made until later this year – after the Department of Insurance has weighed in on any rate increases Blue Cross proposes – and Wilson said "everything is on the table," from dropping ACA coverage in some or all North Carolina counties to cutting back on the menu of plans the company offers.

"We're going to work hard to make it work for North Carolina," he said, calling providing ACA coverage "part of our mission."

Blue Cross is the only insurer to offer marketplace plans in many North Carolina counties, so any scaling back could leave some state residents without coverage options.

"That would be a very unfortunate outcome," he said.

Wilson said the health care law needs to be changed to make it more stable for insurers. He called for fewer enrollment periods and for stiffer penalties for people who don't sign up for coverage.

"Not enough healthy people are signing up for the ACA," he said. "The evidence is building that (the tax penalty) is not strong enough to attract a large enough pool, a diverse enough pool, to sustain the ACA."

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.