AG Cooper announces $21.5M settlement over mortgage lending crisis

The North Carolina Attorney General's Office announced a $21.5 million settlement Tuesday with Standard & Poor's Financial Services.

Posted — UpdatedThe money is part of S&P's total $1.38 billion settlement with the U.S. government, 19 states and the District of Columbia for knowingly inflating its ratings of risky mortgage investments that helped trigger the financial crisis.

Under the agreement, S&P admits that it allowed "the pursuit of profits to bias its ratings," the Justice Department said.

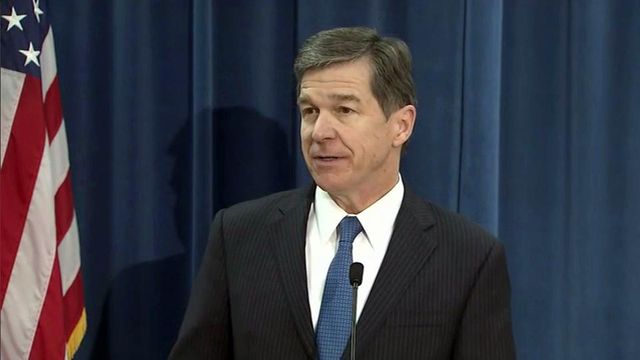

“Good ratings led investors to make bad bets on risky securities, contributing to job losses and foreclosures that hit taxpayers and businesses in North Carolina hard,” said N.C. Attorney General Roy Cooper. "This settlement is a step toward righting the wrong and preventing future harm."

North Carolina’s share of the S&P settlement will benefit North Carolina schools, with more than $2.1 million in fines going to the state Civil Penalty and Forfeiture Fund. Cooper said he would like the remaining money – about $19.45 million – to be invested in two areas.

Lawmakers will have the final say over how the money will be spent, but Senate majority leader Sen. Harry Brown, R-Onslow, said Cooper's recommendations will be considered.

"We'll look at what he has and talk about it and see where it leads," Brown said.

Gov. Pat McCrory released a statement Tuesday, saying he is "very pleased with the settlement."

“This good news allows us to incorporate an additional $21.5 million in our $20 billion budget recommendations as we focus our investments in jobs, education, public safety, public health and transportation," he said. "We also welcome the new attention toward a decade-old problem in our state crime labs. I appreciate the work of the Attorney General and his staff on this settlement.”

At a news conference Tuesday, U.S. Attorney General Eric Holder said S&P's leadership "ignored senior analysts who warned that the company had given top ratings to financial products that were failing to perform as advertised."

Company executives "complained that the company declined to downgrade underperforming assets because it was worried that doing so would hurt the company's business," Holder added. "While this strategy may have helped S&P avoid disappointing its clients, it did major harm to the larger economy, contributing to the worst financial crisis since the Great Depression."

• Credits

Copyright 2024 by WRAL.com and the Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.