NC tax expert: 'Stop and investigate' illegal immigrants' tax refunds

Less than a month after the WRAL Investigates team reported on a tax fraud scheme involving suspected illegal immigrants, a Wake Forest certified public accountant has come forward to say she has questioned some of her own clients' suspicious behavior.

Posted — UpdatedThe tax fraud scheme is a $4 billion problem across the U.S. that involves suspected illegal immigrants getting billions of dollars in tax credits for children who don't live in America, or don’t even exist, according to the Treasury Inspector General for Tax Administration.

“It's just ridiculous how easy it is for people to qualify for these credits,” said CPA Nancy Dawkins.

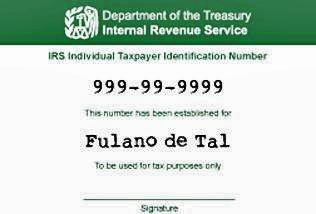

U.S. citizens’ Social Security numbers are used when processing tax returns. Illegal immigrants, or people in the U.S. on work visas, use an Individual Taxpayer Identification Number, or ITIN.

The WRAL Investigates team tracked audits warning the IRS for years about child tax credits and easy-to-get ITINs that open the door for illegal immigrants to defraud the system. When the credits became refundable, the claims exploded.

Dawkins says she has questioned clients who changed their taxpayer ID numbers and their children's names to work the system. “That's a big clue. If you don't know the names of your children, maybe these aren't your children,” Dawkins said.

Following WRAL’s stories last month, two Charlotte women – Candida Figueroa and Cathy Cisneros – pleaded guilty in a $5-million tax fraud scheme. Agents confiscated hundreds of refund checks, lists of Hispanic names, a box of Mexican birth certificates and tax returns sent out to people linked to falsified documents.

“They want to send out these refunds so fast. Stop and investigate before you hand it out. Does this make sense?” Dawkins said.

Lawmakers and the IRS need to make the credit only a deduction, not a refund, according to Dawkins. They also need to make only children in the U.S. eligible and step up monitoring to verify claims are legitimate.

“We're spending an enormous amount of money on fraud. Let's use our money efficiently and really help the people that need it,” Dawkins said.

The IRS may get direction from Congress soon. There are two proposed bills. One would tighten the background checks on ITIN returns, and the other would eliminate the child tax credit for non-citizens.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.